Large Call to Action Headline

HOW IT WORKS

Yes, you got this! No more wasting your valuable time trying to decipher your credit reports or keep track of your reports and letters. We can manage it all for you and it’s free! Just purchase your credit reports through our partner credit monitoring provider!

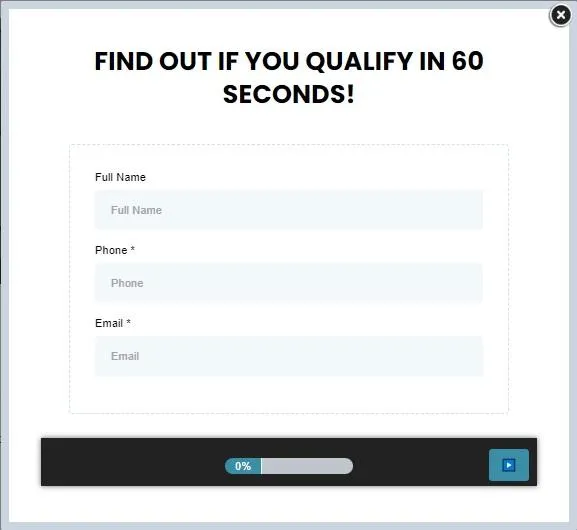

STEP 1

GET STARTED

It’s easy, and only takes a few minutes. First, click the,

"FIND OUT IF YOU QUALIFY" button and answer the following questions. With our fully online enrollment process, there are no pesky sales calls!

STEP 2

Credit Report

Then, follow the simple instructions to get a copy of your credit reports so you can analyze it and determine which derogatory items to dispute.

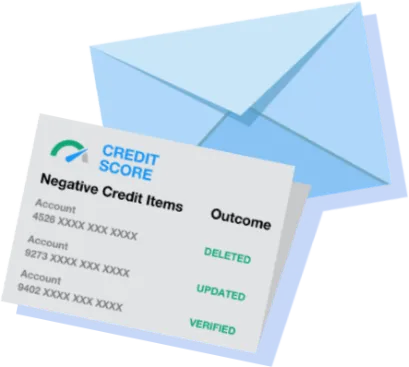

STEP 3

SELECT ITEMS & SEND LETTERS

After you have received your credit report, select the items you see that are inaccurate, then send your letters to the credit bureaus.

STEP 4

SIT BACK & RELAX

When the credit bureaus receive your sent letters, they will conduct an investigation of the items you challenged.

STEP 5

RESULTS

Your results should arrive within 45-60 days or so. If your credit report still has errors, follow up with the DIY course to review your reports to see the next steps to getting the inaccuracies corrected.

STEP 6

REPEAT

if the errors are still on your credit report, you can apply more pressure with advanced disputing methods.

STEP 7

Build & Optimize Credit

Along the way, you’ll be offered credit building products (loans, credit cards, etc) that may meet your financial goals and expand your credit profile.

What are you waiting for?

The only thing you have to lose is bad credit!

Data Score, Inc is the proud owner of this website.

Under federal law you have the right to receive a Credit Report from each of the three nationwide consumer reporting agencies once every 12 months. A Credit Score is not included.

IMPORTANT: MyScoreShield is not a credit repair service organization. We do not claim to fix your credit as we are a DIY educational platform that provides informational purposes only.

You have a right to dispute inaccurate information in your credit report by contacting the credit bureau directly. However, neither you nor a credit repair company or credit repair organization has the right to have accurate, current and verifiable information removed from your credit report. The credit bureau must remove accurate, negative information from your report only if it is over 7 years old. Bankruptcy information can be reported up to 10 years. Credit bureaus are required to follow reasonable procedures to ensure that the information they report is accurate. However, mistakes may occur. You may, on your own, notify a credit bureau in writing that you dispute that accuracy of information in your credit file. The credit bureau must then reinvestigate and modify or remove inaccurate or incomplete information. The credit bureau may not charge any fee for this service. Any pertinent information and copies of all documents you have concerning an error should be given to the credit bureau. If the credit bureau's reinvestigation does not resolve the dispute to your satisfaction, you may send a brief statement to the credit bureau to be kept in your file, explaining why you think the record is inaccurate. The credit bureau must include a summary of your statement about disputed information with any report it issues about you.

All product and company names and trademarks mentioned herein are the property of their respective owners.